When three companies came together to form top-flight custom circuit board company Summit Interconnect, the industry had been offshoring capabilities for years. Now, new market growth and an increased military interest – and defense budget – show it was worth the wait.

Summit Interconnect is a custom circuit board manufacturing company based in California with three locations in Anaheim, Orange, and Santa Clara. CEO Shane Whiteside recounts how the company came together with help from a private equity sponsor.

The company began with a strategy of forming a “fully capable, well-positioned, large scale” circuit-board manufacturer through the acquisition of highly capable, high-technology companies. The campaign began with the acquisition of KCA Electronics in 2016, which was followed by MEI (Marcel Electronics International) within the same month, the two of which would form the foundation of what Summit is today.

The combined companies were soon renamed, and focus was put on building the brand name within the industry. Investments and improvements in the acquired companies continued into 2018 when the third acquisition was made: Streamline Circuits of Santa Clara, California. Streamline doubled the size of Summit in terms of sales value and was a good fit for the new company due to its ability to produce advanced technology PCBs in compressed lead time and its location in the heart of Silicon Valley.

Whiteside describes Streamline as “committed to operational excellence” and offering the highest technology in its class; which in turn has improved and expanded the product offering of Summit. Whiteside notes that as the circuit board industry has been around for several decades, introducing a new name into it was in itself an effort. The idea was to adopt the “Summit” brand name to suggest to its customers a business that was headed to the top.

Advanced technology

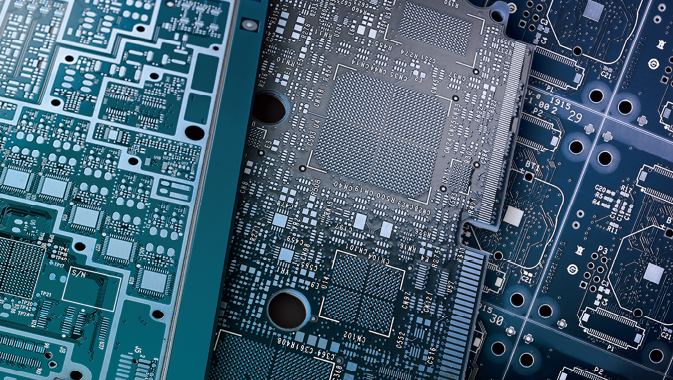

Whiteside says the company is “aligned on all fronts in terms of vision and approach.” Both Summit’s manufacturing facilities and the products it builds could be described as within the highest technology segments of industry. The company focuses primarily on building high density, rigid, printed-circuit boards; flexible and hybrid rigid-flex circuit boards; RF (radio frequency) microwave circuit boards; and semiconductor test printed-circuit boards.

The largest vertical markets served by Summit are within aerospace and defense, with the company identified as one of the leading providers for these sectors in the circuit-board market in North America, by virtue of its focus on delivering unparalleled reliability, collaboration, and scale, in its services and partnerships. Whiteside also mentions that a lot of sales have come from the semiconductor test and reference market, as well as the medical and computing markets. In the established printed circuit board (PCB) market, says Whiteside, “Our technology and capabilities are what set us apart.”

As a build-to-print manufacturer, Summit’s business involves entering into a manufacturing partnership with customers in which the company takes a customer’s design, builds the desired product to the design, and ships it back to the customer. The company’s approach to customer service and early engineering involvement is described as one that seeks to deepen and add value to any given business relationship by adding value on the front end with design, collaboration, and assistance with manufacturability.

Strong capabilities

This helps to ensure that customers understand the advanced technology capabilities of Summit and use these capabilities to expand the options with their designs. This capability keeps Summit aligned with the customer’s vision for the end product. Summit also always works very closely with its suppliers, as they routinely supply highly specialized materials and support for its various PCB products. Throughout its processes the company uses advanced and purpose-adapted laminates and laminating systems, along with proprietary chemicals for copper and gold deposition, to extract superior electrical performance from its products.

The relationship with suppliers also includes technical components on a different level. Suppliers typically have a lot of process engineering to deal with, so they work with Summit’s factories and engineers to help these processes run at the highest yield possible, while sporting the finest features and processing capabilities that are possible at today’s level of manufacture. Whiteside observes that the company’s suppliers are “critical in making these processes possible,” and are vital to its continued success.

Facing the challenge

Whiteside explains that the circuit board industry in North America has gone through significant changes in the last two decades because it has both “increased globally but also shrunk significantly domestically,” due to the offshoring of projects and the concentration of the industry in low-cost regions around the world. Statistics show that the industry is now only about a third of what it was 20 years ago, sales-wise – a challenge to be faced.

The printed circuit board industry in the year 2000 was worth about $40 billion, Whiteside remembers, $10 billion of which was produced in North America. Since then, the world market has grown by about 50 percent to $60 billion (largely through the proliferation of electronics and devices) while the domestic market has shrunk to less than $3 billion, “eviscerated by globalization.”

In fact, there were at one time over 800 printed circuit board companies in North America, but recent estimates place the count around 180, with many of those remaining being under-invested, in the main due to a lack of appetite from businesses within a shrinking domestic market.

Ramping up

It seems, as well, that the bleeding-edge nature of advanced technology and design, at least in the minds of the industry’s customers, can cause unforeseen issues in the manufacturing process when it comes to product quality, scheduling, and delivery. Whiteside likens being on the bleeding edge to “being on the edge of the cliff,” emphasizing just how inherently precarious a company’s immediate future can be. Summit has met this challenge by growing its business in the last couple of years and ramping up its capacity to meet the demands of its markets, with the purpose of accelerating its return on investment and continuing to provide the best service it can.

Despite significant challenges in the circuit board industry, in the last two years Summit Interconnect has experienced growth as a company – and the domestic industry has also for the first time since 2000. This market growth has enabled the company to expand, and in turn given it even greater conviction in committing to its strategy of investing in its business for the long haul.

Organic growth

Factors contributing to this include a growth in the national defense budget, and an increased emphasis by the United States military on utilizing electronics to improve its battlefield capabilities. To Summit, this new challenge is an exciting opportunity to invest in ramping up factories, hiring and training new people, and creating a return on investments.

Whiteside is anticipating that Summit will “continue going strong in the North American circuit board market into 2020 and beyond.” He believes that a lot of the factors enabling growth will remain in place, and the company is expected to continue growing organically, along with gaining additional capital investment, hiring more people, and making further acquisitions.

Summit Interconnect has set its sights on continuous improvement, and with the PCB industry experiencing a rise in fortune for the first time in nearly 20 years, it seems to be the right time for the company to take its product offering and unique approach to the next level.