The history of international trade goes back centuries. However, the first wave of globalization in the nineteenth century was interrupted by the outbreak of the ‘Great War’ in 1914, when trade took a back seat to conflict.

It was during the height of World War 1, in 1915, that Possehl Erzkontor, headquartered in Lubeck, Germany, was established to trade raw materials globally. With over a century of growth, the company continues to advance and evolve into a recognizable giant on the world stage. It currently has nine locations serving Europe, South America, (Southern) Asia, South Africa, and North America.

In 2008, Possehl Erzkontor (PE) developed an office in Cleveland, Ohio, which moved to Cincinnati in 2018 – the only location, so far, in the United States. The subsidiary is known as Possehl Erzkontor (North America), or PENA.

“The steel refractory industry was our main customers,” explains Niklas Luedemann, PENA’s general manager, of the choice of Ohio. Steel industry customers are located not only in Ohio but in Pennsylvania, Illinois, and Michigan. He adds that the company’s founder and former general manager lived in Cleveland and desired an office close to home.

The company’s history began with the “trading of iron ore from Sweden to Europe. At that time, we were one of the major players to supply the steel industry for quite some time,” says Niklas. During the 1960s and 1970s, when international trade with China began in earnest, “we focused more on importing from China, Asia, and international markets.”

Founding PENA was a logical step for Possehl Erzkontor since the trading company wanted to apply its market knowledge and teams “to open up the United States and North American markets to us,” says Niklas, “and do exactly the same thing we do in Europe.” The rationale was to serve the refractory and ceramics industry in particular, two of the industries in North America on which the company initially focused.

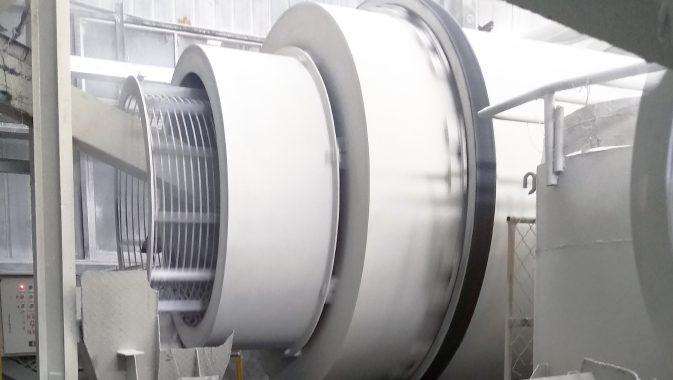

Tabular, reactive, and calcined alumina – used in ceramics and abrasives, among other uses – are three of PENA’s bestselling and most in-demand products. “We have a great partner in China that we work with.” But what makes Possehl Erzkontor stand out from other suppliers producing in China is the location of its source materials. “Our raw material for the production is imported from Australia. This gives real purity in the product.” These three alumina products possess a clear white color, which “gives us one big advantage.”

Additionally, since PENA has larger shipments from China to the United States, there is “a cost advantage in the logistics,” Niklas continues. Other in-demand products include fused magnesite, deadburnt magnesite, and bauxite, used in making linings for blast steel furnaces and other applications,

PENA’s objective is to be a crucial player in the North American alumina industry, and it possesses the unique advantages to do just that. “One of our biggest advantages is the logistics,” adds Niklas. “In 2019, we imported a total of 110,000 metric tonnes, using great logistics, which gives us advantages for freight, which makes us competitive.”

Also, since Possehl Erzkontor is such a huge corporation, this brings other benefits. “We have great financing terms and can offer long payment terms as well as warehousing and consignment storage. That also differentiates us from the competition and direct importers from China.”

The knowledgeable group at PENA’s Cincinnati office is a multilingual one, with people who speak German, Spanish, and other languages. Niklas emphasizes that it is all about “the customer service, always being available, and always providing feedback. We don’t want the customer to ever feel ignored.” He adds that working with a global sales and sourcing team provides “a team of experts that can support us with any questions that we may have.”

Possehl Erzkontor has secured many global scale partnerships throughout its long history. For its best-selling alumina products, PENA has had over a decade of a great partnership with China’s TBL, “a major player in the market,” Niklas notes. “We work together. We invested in the company; we gave them loans, and we gave them prepayments to finance the production… They were the first ones that were able to export with stable quality.”

It is essential to get the right quality of product at the right time, and to do that, “It’s important to know the right people and to have trust.”

It should be noted that in November of 2019, PENA signed a memorandum of understanding with Lithium Energy Products (LEP) to act as LEP’s sales agent for global distribution of the fluorspar being produced at LEP’s Lost Sheep Mine in Utah.

Niklas explains that the company has demand in the United States, and being prepared to produce “within a timeframe of half a year or less is a key factor. Fluorspar is a strategic mineral all over the world,” he adds. “We’re excited about it.”

Possehl Erzkontor is a member of the family-owned Cremer Group, headquartered in Hamburg, Germany and established in 1946. In 2014, Cremer acquired the Possehl group. “It was a great development for us because Cremer is a $3 billion corporation,” that fully comprehends the trading business with offices globally.

Niklas and his team are growing excited about attending the upcoming Ceramics Expo, a networking forum for companies in the ceramics and glass supply chain, taking place in Cleveland in May 2020. PENA’s partnered producer TBL will be in attendance as well. “It’s a good chance for them to meet the customers face-to-face, and the customer can put a face to the producer who stands behind the product,” says Niklas. “That is one important step for us.”

The exposition will also provide a venue to reach out to the medium and smaller producers, “who are not used to importing from China,” he adds.

The ten percent tariffs imposed by the Trump government in 2018 on imported aluminum products were a concern. Niklas explains that they did not have to pay these tariffs, but months went by when these tariffs were expected to be enforced. “So there was a lot of uncertainty,” he says. “If there was a shipment coming in worth one or two million dollars and you’re not sure if you have to pay import tariffs or not, that was definitely a challenging time.” The tariffs on aluminum were eventually lifted after weeks of lobbying from the industry.

At the same time, the exchange rate from U.S. dollars to RMB (the people’s renminbi, the official currency of China) oscillated a lot, which “also fluctuated our price between five and six percent. The whole time this was going on, there is less stability in the market, less stability in the pricing, and especially giving long-term pricing was a challenge. But we managed to keep all our contracts. We didn’t have to increase the price once, which was really fortunate for us and an important promise to our customer.”

“People are really used to buying these products domestically. There are strong domestic partners/suppliers,” Niklas explains. “It’s a challenge to import from China because sometimes you have lead times of over two to three months. You have to have the right inventory in the warehouse at any given time.” But the company is persistently working to have “a better grasp of the market and understand what our customers need, at which time, so that we can do better planning.”

Niklas credits the company’s employees for its long history of success. He cites “the energy that everybody brings to the table, always being available, and always putting the customer first.”

And certainly the firm’s numerous long-term partnerships with China play a crucial role in this success. It is partnerships like this, which “really makes us strong and established players in the market. We’re someone that people can trust quality-wise, price-wise, and contract-wise.”

Diversification is another component of PENA’s overall success. Aside from the refractory and ceramics industry, the company is also “active in plastics and industrial chemicals,” explains Niklas. “We have different markets; we have a good idea about the economy all around the world to give the customer a good indication of where the market is going – gives us a good idea about supply and demand.”

Niklas emphasizes that importing raw materials should be part of the sourcing plan for the supply team of even small and mid-sized companies. “We want to take the fear away from people to look into imports and non-domestic sources. We think we can be a good partner, having the experience of multiple years already.”